Are biosimilars set to disrupt the US pharmaceutical industry?

Check out our latest post about the future of the WORKFORCE IN THE BIOSIMILARS AND BIOPHARMA MARKET

Earlier this year, the FDA approved Sandoz’ oncological drug, Zarxio, the first biosimilar to be approved in the United States. “A biosimilar can only be approved by the FDA if it has the same mechanisms of action, routes of administration, dosage forms and strengths as the reference product, and only for the indications and conditions of use that have been approved for the reference of that product. The facilities where the biosimilars are manufactured must also meet with the FDA standards.” Zarxio is a biosimilar to Amgen Inc.’s Neupogen (filgrastim), and has been approved to treat the same symptoms:

- patients with cancerreceivingmyelosuppressive chemotherapy;

- patients with acute myeloid leukemia receiving induction or consolidation chemotherapy;

- patients with cancer undergoing bone marrow transplantation;

- patients undergoing autologous peripheral blood progenitor cell collection and therapy; and

- patients with severe chronic neutropenia.

Zarixo is the first FDA-licensed biological product resulting from The Biologics Price Competition and Innovation Act of 2009 (BPCI Act), signed into law in March of 2010. In a statement released by Novartis on September 2015, Richard Francis, the Global Head of Sandoz (a Novartis company, and producer of Zarixo), said this of the drug: “With the launch of Zarxio, we look forward to increasing patient, prescriber and payor access to filgrastim in the US by offering a high-quality, more affordable version of this important oncology medicine.”

Catching up to the international biosimilars market

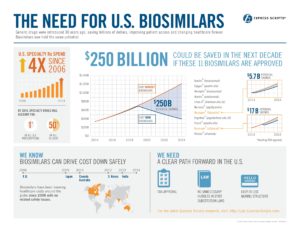

Zarxio’s launch established the US biosimilars market, a nascent subindustry that is projected by some estimates, to account for 4% – 10% of the $190B biologics market by 2020. In fact, an analysis of the future biosimilars market projects that 50% of the biologics market will belong to off-patent drugs, creating a high market potential for biosimilars.

2020 (equating to $10 – 25 billion), depending the number of new biosimilars introduced — and most

especially on the number available in the U.S. It is highly unlikely that biosimilars can claim 10 percent of global biologics sales without a strong biosimilars market developing in the U.S., since the country is the largest biologics market in the world, with the highest per-capita consumption of biologic products.” (IMS Health) Source: Decision Sciences Group

With the approval of its first biosimilar, the US is joining the rest of the global biosimilars market: “Japan, Australia and Europe have approved 6, 8, and 19 biosimilars already, and the global market rose from $1.1M in 2007, to $86.9M in 2014, with a market penetration in European and emerging markets of about only 8%.

At the time of this article, there are currently 29 biosimilars in clinical trials in the United States.

The big question is, will they survive the rigorous regulatory process?

Ahead of the US, Europe is leading the biosimilars rush with 29 biosimilars in trials. India alone is testing 19 biosimilars. Other than Sandoz/Novartis, top players are: Hospira, Amgen, Mylan, and Pfizer.

Hospitals and insurance companies are counting on biosimilars to foster a competitive market that will drive the price down on many prescription drugs (specifically those dealing with chronic diseases). However, it must be noted that it is still hard to estimate how much less expensive a biosimilar will be than its reference drug, as the prices vary, and are still market-dependent.

Here in the US, Zarxio sells for 15% less than Amgen’s Neupogen.

—