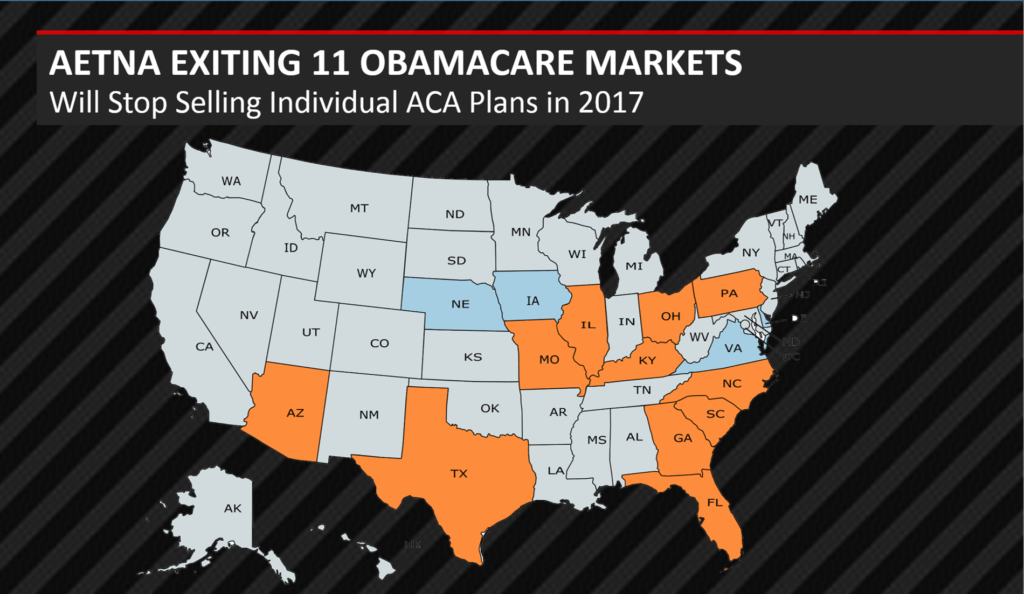

Insurers are leaving Affordable Care Act marketplaces and it’s leaving them in turmoil. As the fourth enrollment season continues, consumers may be affected differently depending on where they live. Next year, three of the nation’s largest health insurers–Atena, UnitedHealthcare and Humana– plan to sell individual plans in fewer markets. Additionally several Blue Cross and Blue Shield plans will not be offered in as many markets. Aetna is pulling out of 11 of the 15 states where it offers Obamacare policies after losing upwards of $430 million. This followed a downsizing announcement by UnitedHealthcare, which will now only operate in three states in 2017, while Humana is withdrawing from nearly 1,200 counties in eight states.

A Major Shakeup for Obamacare

Three years after the exchanges opened, Obamacare is suffering a major setback. According to a recent CNN Money article, “Those who’ve signed up for coverage are sicker and costlier than expected, while too many healthier Americans are opting to pay a penalty rather than a premium.” This is causing many insurer to raise their rates by double-digit percentages in 2017 to compensate for minimizing their presence on the market.

Despite the current turbulence in Obamacare, the system is working for some people and has become a staple of the healthcare landscape. Today, more than 11 million people are covered by Obamacare policies, with 85 percent of them receiving federal subsidies that mitigate the impact of the premium hikes. The result has been a decrease in the uninsured rate to a record low of 9.1 percent. Most marketplace consumers won’t experience any negative effects from these insurers’ withdrawals, according to health law advocates and independent analysts. Largely, the big insurers’ decision to leave marketplaces will affect only the individual market, while the larger market of employer-sponsored insurance is not part of the exchanges.

Why Are Companies Leaving Exchanges?

Simply put, all three major insurers said they are losing money on the plans, while the Department of Health and Human Services agues that insurers should blame themselves for setting premiums too low. While the DPHS claims that Aetna and other insurers’ decision to leave exchanges won’t affect the government’s ability to continue to bring quality coverage to millions of americans next year, those who will see their premiums double would most likely beg to differ. North carolina will be left with only one or two plans throughout most of the state after losing both Aetna and UnitedHealthcare. However, this opens the door to opportunity for smaller carriers, who will likely attempt to enter markets the three giant companies are leaving. Additionally, even some larger insurers are planning on entering these markets. Cigna says it plans on moving into some North Carolina counties next year.

Fewer Choices For Consumers

Insurers leaving the marketplace means constricted choices for consumers. In many cases, like I mentioned above, consumers are left with only one or no health insurance options, which threatens the law’s promise to increasingly insure those who have either been too sick or too poor to access coverage historically. Atena’s decision to leave was, in part, a retaliation against the recent Department of Justice lawsuit that sought to block a proposed deal to consolidate the nation’s five biggest health insurers into three. For many people, insurers’ decision to pull out will be a lot more than a minor inconvenience. To put it into perspective, approximately 670,00 people who had Aetna in june will lose their plans and will need to choose new ones. They can choose to either go uninsured or pay more policies by buying plans outside the exchanges, according to US News World and Report. They may also have to transfer all of their medical records to a new facility if they are in need of specialized care.

Why is Obamacare Not Working the Way it Should?

Big insurers are leaving public exchanges because they simply can’t figure out how to turn a profit selling coverage through them. This calls into question the long term stability of the entire Obamacare health reform. And meanwhile, insurance premiums are set of a major hike next year. To many health care analysts, these are red flags that we ought to be worrying about. The law sought to incentivize all americans to buy insurance or penalize them if they don’t. The idea was that the healthy customers would balance out the ill ones and the universal healthcare system would work based on diversified risk. However, insurers like Aetna have still been losing money, partly because they may have needed to deliberately underprice their plans to attract customers. Additionally, they’ve have trouble winning over young, healthy, profitable adults to balance out older and sicker patients.

Critics say that administration officials and democrats are “kidding themselves if they continue to ignore glaring fundamental problems with the structure and rules of Obamacare,” the Fiscal Times said. Robert Laszewski, a healthcare industry consultant and blogger who believes there are significant shortcomings in the program says that we may be in the beginning of a “death spiral”. “The more your raise the rates, the worse it gets,” Laszewski told the Fiscal TImes. “You can’t raise the rate high enough when you have too many sick people in the pool. You need healthier people. And the subsidies keep the poorest people in the pool no matter what it costs.”

Is your organization in need of a new Healthcare hire?

Get in touch with us today to get started.

Image Credits: NHBR, Appsruntheworld